Motorcyclist Seriously Injured In Cantonment Crash

March 22, 2020

A motorcyclist was seriously injured in a crash in Cantonment.

Curtis Evangelista, 36, was traveling south on Highway 297A when he lost control of his Harley Davidson motorcycle while turning onto Bentley Oaks Drive about 6 p.m. Friday, according to the Florida Highway Patrol. The side of the motorcycle collided with a curb in the median divider of Bentley Oaks.

Evangelista was transported to Sacred Heart Hospital in critical condition.

File photo.

Escambia Clerk of the Circuit Court And Comptroller Announces Changes Due To COVID-19

March 22, 2020

Escambia County Clerk of the Court Pam Childers released the following information:

In an effort to balance the safety of our personnel and the community while providing critical functions and court services, the following information regarding changes to the Escambia County Clerk of the Circuit Court and Comptroller services are below.

Per court order, the MC Blanchard and Theodore Bruno Juvenile Justice Building remain open, at this time, but have limited public access. The Clerk’s office will continue to process emergency court services:

- Petitions for Dating Violence, Domestic Violence, Repeat Violence, Sexual Violence or Stalking Injunctions

- Baker Act petitions

- Marchman Act petitions

- Vulnerable Adult petitions

- Adult Protective Services petitions

- Emergency guardianship appointment

- Family Law and Dependency cases in which the imminent safety of children is at issue

To make payments and access other services, please visit our website at escambiaclerk.com.

The following Clerk’s offices will be closed effective March 23 until at least March 30:

- Traffic Office, MC Blanchard Judicial Building, 190 W. Government St.

- Marriage Office, MC Blanchard Judicial Building, 190 W. Government St.

- Clerk’s Official Records, Finance and Clerk to the Board Offices located at 221 Palafox Place

- Century Courthouse office

- The Public Records Center, 120 E. Blount St.

The following services will be suspended until at least March 30:

- Marriage licenses

- Passports

Traffic Crash Claims Life Of Escambia County Woman

March 21, 2020

A crash Friday claimed the life of an Escambia County woman.

The Florida Highway Patrol said 60-year old Wanda Lou Celli pulled her Toyota Matrix from a stop sign on Webb Lane into the path of a Jeep Wrangler traveling on Mobile Highway. Cellie was transported to Baptist Hospital where she was later pronounced deceased.

The driver of the Jeep, 82-year old Ray McCulley of Pensacola, was taken to Sacred Heart Hospital for treatment of minor injuries.

No charges were immediately filed as the investigation continues.

Pedestrian Critical After Being Hit Friday Night Along Highway 29

March 21, 2020

A pedestrian was struck by a vehicle and critically injured Friday night.

It happened about 8 p.m. near the intersection of Highway 29 and Tate School Road.

The victim was transported to a local hospital as a “trauma alert.” Their name and update on their condition was not available.

The Florida Highway Patrol is continuing their investigation.

File photo.

High Speed Internet Will Be Available To Students At Escambia Libraries, Community Centers

March 21, 2020

As the Escambia County School systems moves toward the start of virtual instruction on April 1, Escambia County is making libraries and community centers available for students.

Students without an adequate internet connection at home will be able to use the high speed internet at county libraries and community centers.

It some instances the internet access may only be able outside community centers. If the community center buildings are opened, or in the libraries, CDC recommendations will be followed for cleaning and distancing.

Details on exactly how the program will work will be finalized and published prior to April 1, the date Escambia County students begin online classes.

“When we learned from Superintendent Thomas that the District needed help with a solution for children who lived in areas with limited internet access…we wanted to step up and partner with them immediately,” said Escambia County Commission Chairman Steven Barry. “We will work with the District to provide direct assistance so children are able to complete their school work and to learn remotely wherever they possibly can. Our Escambia County community centers and libraries offer the availability of high speed internet connectivity and plenty of space for students to spread out and continue to further their education. We will also be focusing on enhancing and even adding infrastructure to existing facilities and areas in the attempt to improve the positive impact we can have in the partnership.”

Escambia County School District Superintendent Malcolm Thomas said, “For our education continuity plan to work, to truly help our students stay engaged in their learning during the pandemic interruption, it will take teamwork between our teachers, support staff, students and their families. For some of those families, a lack of internet connectivity is a roadblock to their students’ success. Although, our instructional plan provides for the use of books and paper packets, the most robust instruction will occur through virtual sources. The connectivity provided throughout the county will allow these students access to their lessons over the internet enhancing their opportunity for greater academic success.”

“It is this kind of community support, during any kind of crisis we have experienced, hurricanes, tornadoes, floods, the freeze and now a pandemic, that makes Escambia County an outstanding place for all of us to live and work. Thank you Commissioner Barry for your leadership and please express the school district’s gratitude to the other Commissioners and let the staff members who will be helping our students know that they are making a difference in a difficult time,” Thomas added.

Santa Rosa’s Third COVID-19 Case In A Teenager; Still One Confirmed Case In Escambia

March 21, 2020

A teenager is the third confirmed case of coronavirus in Santa Rosa County.

It is not traveled related, according to an update from the Florida Department of Health, and the 17-year old male did not have contact with a previously known case.

Santa Rosa County’s first case was announced March 5. The 71-year old man traveled to Egypt, Israel and Jordan. He died at Baptist Hospital In Pensacola. A 48-year old male with a travel history to the United Kingdom was the county’s second case.

The number of cases in Escambia County remained at one, a 53-year old male that traveled to France.

Meals For Kids Available Next Week At West Florida Library Locations

March 21, 2020

Escambia County West Florida Public Libraries are partnering with Feeding the Gulf Coast to provide free curbside pickup meals for youth ages 18 and under at all library branch locations, Monday-Friday from 11 a.m. to 1 p.m., beginning Monday, March 23.

The meals will include lunch and a snack, and meals will be available on a first come, first served basis.

Youth must be present to receive meals; food will not be given to adults.

Meals will be available for pickup only at the locations listed below Monday-Friday from 11 a.m. to 1 p.m.:

- Molino Branch Library, 6450-A Highway 95A, Molino

- Pensacola Library, 239 N. Spring St., Pensacola

- Tryon Beach Library, 1200 Langley Ave., Pensacola

- Genealogy Branch Library, 5740 N. 9th Ave., Pensacola

- Southwest Branch Library, 12248 Gulf Beach Highway, Pensacola

- Westside Branch Library, 1301 W. Gregory St., Pensacola

- Century Branch Library, 7991 N. Century Blvd., Century

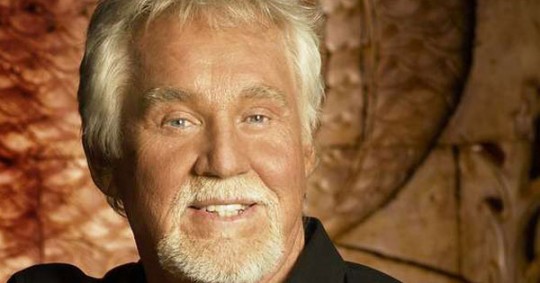

Country Music Icon Kenny Rogers Dies At 81; ‘The Gambler’ Had Pensacola Connections

March 21, 2020

Legendary country music icon Kenny Rogers passed away Friday night at age 81.

Rogers performed in Pensacola several times, including a benefit concert after Hurricane Ivan at the request of his former producer, the late Larry Butler of Pensacola.

In a career that spanned more than six decades, Kenny Rogers left an indelible mark on the history of American music. His songs have endeared music lovers and touched the lives of millions around the world. Chart-topping hits like “The Gambler,” “Lady,” “Islands In The Stream,” “Lucille,” “She Believes In Me,” and “Through the Years” are just a handful of Kenny Rogers’ songs that have inspired generations of artists and fans alike. Rogers, with twenty-four number-one hits, was a Country Music Hall of Fame member, six-time CMA Awards winner, three-time GRAMMY® Award winner, recipient of the CMA Willie Nelson Lifetime Achievement Award in 2013, CMT Artist of a Lifetime Award honoree in 2015 and has been voted the “Favorite Singer of All Time”.

Pictured below: Kenny Rogers (left) with his producer, Larry Butler of Pensacola.

DeSantis Orders Cancellation Of All Elective Surgeries

March 21, 2020

In order to provide relief to hospitals that are, or might be, stretched thin due to the coronavirus, Gov. Ron DeSantis has ordered the cancellation of all elective surgeries.

“All hospitals, ambulatory surgical centers, office surgery centers, dental, orthodontic and endodontic offices, and other health care practitioners’ offices in the state of Florida are prohibited from providing any medically unnecessary, non-urgent or non-emergency procedure or surgery which, if delayed, does not place a patient’s immediate health, safety or wellbeing at risk, or will, if delayed, not contribute to the worsening of a serious or life-threatening medical condition,” the governor’s office said.

The order continues until the end of the current COVID-19 State of Emergency.

Cabinet Member Calls For DeSantis To Issue Statewide ‘Stay At Home’ Order

March 21, 2020

Florida Agriculture Commissioner Nikki Fried is asking Governor Ron DeSantis to implement a statewide “stay-at-home” order in response to the increasing number of COVID-19 cases in the state.

“I want to recognize the difficult choices the Governor has had to make in this public health crisis. No Governor in recent history would have expected to have to make a decision like California, New York, or Illinois have made in the past 72 hours,” Fried, the only Democrat holding an elected statewide office, said in an email.

“Shutting down one of the nation’s largest states is a decision that will have an economic impact — but it is a decision that will save lives. Based on the data, we know we are a week behind California’s vast increase in COVID-19 cases. The individuals and businesses I’ve spoken with are growing more anxious by the day. As the nation’s third largest state, we need to go further, and we cannot afford to lose another week.”

She said a single order would be more effective than the “piecemeal approach” of increasing closures.

Early in the week, the governor ordered bars to close for 30 days and cut the seating area of restaurants by half. On Friday, he completely closed restaurant dinings rooms, along with gyms and fitness centers until the current state of emergency ends.