IRS Warns Of Increasing Number Of Local Phone Scammers

January 24, 2015

Area residents are receiving an increasing number of aggressive and threatening phone calls by criminals impersonating Internal Revenue Service agents.

The IRS has seen a surge of these phone scams in recent months as scam artists threaten police arrest, deportation, license revocation and other things. The IRS reminds taxpayers to guard against all sorts of con games that arise during any filing season.

“If someone calls unexpectedly claiming to be from the IRS with aggressive threats if you don’t pay immediately, it’s a scam artist calling,” said IRS Commissioner John Koskinen. “The first IRS contact with taxpayers is usually through the mail. Taxpayers have rights, and this is not how we do business.”

“If someone calls unexpectedly claiming to be from the IRS with aggressive threats if you don’t pay immediately, it’s a scam artist calling,” said IRS Commissioner John Koskinen. “The first IRS contact with taxpayers is usually through the mail. Taxpayers have rights, and this is not how we do business.”

Phone scams have been a persistent and pervasive problem for many taxpayers for many months. Scammers are able to alter caller ID numbers to make it look like the IRS is calling. They use fake names and bogus IRS badge numbers. They often leave “urgent” callback requests. They prey on the most vulnerable people, such as the elderly, newly arrived immigrants and those whose first language is not English. Scammers have been known to impersonate agents from IRS Criminal Investigation as well.

“These criminals try to scare and shock you into providing personal financial information on the spot while you are off guard,” Koskinen said. “Don’t be taken in and don’t engage these people over the phone.”

The IRS will never:

- Call to demand immediate payment, nor will the agency call about taxes owed without first having mailed you a bill.

- Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

- Require you to use a specific payment method for your taxes, such as a prepaid debit card.

- Ask for credit or debit card numbers over the phone.

- Threaten to bring in local police or other law-enforcement groups to have you arrested for not paying.

If you get a phone call from someone claiming to be from the IRS and asking for money, here’s what you should do:

- If you know you owe taxes or think you might owe, call the IRS at 1-800-829-1040. The IRS workers can help you with a payment issue.

- If you know you don’t owe taxes or have no reason to believe that you do, report the incident to the TIGTA at 1-800-366-4484 or at www.tigta.gov.

- If you’ve been targeted by this scam, also contact the Federal Trade Commission and use their “FTC Complaint Assistant” at FTC.gov. Please add “IRS Telephone Scam” to the comments of your complaint.

Northview Girls Weighlifting Team Honors Presented

January 24, 2015

The Northview High School Girls Weightlifting team presented the following awards Friday morning:

- Myisha Syria

- Danielle Robinson

- Lakelynn Parker

- Moriah McGahan

FHSAA Releases Final Football Classifications For Next Four Years

January 24, 2015

The Florida High School Athletic Association has released final football series classifications for the next four years.

The Florida High School Athletic Association has released final football series classifications for the next four years.

Tate, Crestview and Niceville move down from 7A to Class 6A. That creates a local 1-6A with Escambia, Pine Forest, Washington and Tate. Northview, Baker and Jay stay in 1-1A, while Freeport slips over to District 2 Class 1A.

Class 6A

District 1

Escambia

Pine Forest

Tate

Washington

District 2

Navarre

Gulf Breeze

Milton

Pace

District 3

Choctawhatchee (Fort Walton Beach)

Fort Walton Beach

Crestview

Niceville

Class 5A

District 1

Arnold (Panama City Beach)

Bay (Panama City)

Mosley (Lynn Haven)

Pensacola

West Florida

Class 3A

District 1

Pensacola Catholic

Taylor County (Perry)

Florida High (Tallahassee)

Class 1A

District 1

Baker

Jay

Northview (Bratt)

District 2

Cottondale

Graceville

Holmes County (Bonifay)

Sneads

Vernon

Wewahitchka

Firefighters Revive Cats Following Travel Trailer Fire (With Gallery)

January 23, 2015

Two cats pulled apparently lifeless and unresponsive from a travel trailer fire Thursday are alive and well today thanks to firefighters from Escambia Fire Rescue.

Two cats pulled apparently lifeless and unresponsive from a travel trailer fire Thursday are alive and well today thanks to firefighters from Escambia Fire Rescue.

Firefighters from the Ensley and Cantonment fire stations were called to the travel trailer fire in the 6000 block of Untreiner Avenue in Ensley just after noon. The fire was quickly extinguished, saving surrounding structures. Firefighters removed the cats from the fire and revived them using oxygen from specially designed masks donated by the Junior Humane Society and a little tender loving care.

At last report, the cats were doing well.

For more NorthEscambia.com photos, click here.

There were no injuries to people in the blaze. The cause of the fire is under investigation by the Florida State Fire Marshal’s Office.

NorthEscambia.com exclusive photos by Kristi Price, click to enlarge.

Escambia To Settle With IRS Over Firefighter Stipends, Work To Keep Volunteers

January 23, 2015

The Escambia County Commission voted Thursday night to pay back taxes under an IRS audit of the county’s fire services and to work toward keeping things as normal as possible for volunteer firefighters while keeping the IRS and other agencies happy.

Volunteer firefighters in Escambia County currently receive stipend pay for answering 25 percent of their station’s calls during the month, ranging from $300 for a Firefighter I to $550 for a district chief.

Volunteer firefighters in Escambia County currently receive stipend pay for answering 25 percent of their station’s calls during the month, ranging from $300 for a Firefighter I to $550 for a district chief.

The audit was prompted after the IRS discovered that several Escambia County employees were receiving both a W-2, showing taxes withheld from their “day” job with county, and a 1099, showing no taxes withheld as a volunteer firefighter. The IRS found Escambia County should have been withholding taxes on a stipend pay for all volunteers and the county owes over $78,000.

The county will pay the $78,000 and agree to the settlement as offered by the IRS.

Volunteer firefighters will continue to receive a stipend check will taxes withheld, and they will receive a W-2 rather than a 1099 at year’s end. As it stands now, any volunteer that works a paid job for the Board of County Commissioners can’t volunteer for the fire department because of potential tax overtime issues. About a dozen volunteers are impacted.

The commission authorized County Administrator Jack Brown and other staff to continue talks with the volunteers and to find any potential solutions.

Commissioner Wilson Robertson’s motion stated that volunteers should keep their stipends, no additional minimum training beyond Firefighter I should be required and staff should reach out to federal agencies to solve employee volunteer issues. The commission unanimously approved the motion.

NorthEscambia.com file photos, click to enlarge.

Appeals Court Upholds Conviction In Murder Of Former PNJ Reporter

January 23, 2015

An appeals court has upheld the conviction of the man responsible for the murder of a former Pensacola News Journal reporter.

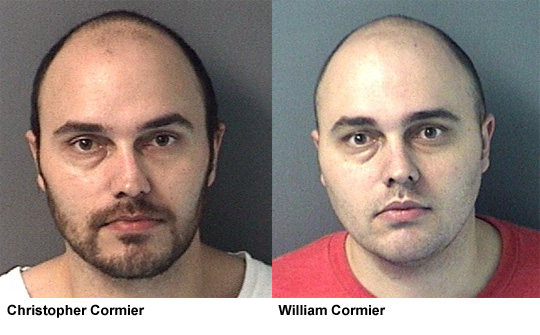

William Joseph Cormier was convicted by an Escambia County Jury of first degree murder on February 13, 2014, and received a mandatory life sentence for the murder of Sean Dugas. Cormier appealed his convcition to the First District Court of Appeals, which upheld his conviction and sentence.

Dugas was reported missing on September 13, 2012. His body was discovered buried in the residential backyard in Winder, GA, where the father of William Joseph Comier lived. In October 2012, Cormier was arrested and later charged with first degree murder. His brother, Chris Comier, was also charged with accessory after the fact to first degree murder.

Chris Comier pleaded guilty and was sentenced to 15 years in state prison in February 2014.

Ernest Ward Names January Students Of The Month

January 23, 2015

Ernest Ward Middle School has named January Students of the Month. They are: (L-R) Addison Albritton, seventh grade; Amber Gillman, sixth grade; and Dalton Hamilton, eighth grade. Photo for NorthEscambia.com, click to enlarge.

Gulf Power, Military Bringing Large Scale Solar Power To Area

January 23, 2015

Gulf Power is partnering with the U.S. Navy and U.S. Air Force to build solar energy farms at three different facilities across Northwest Florida. Today, the utility submitted the renewable projects to the Florida Public Service Commission (FPSC) for approval. The projects could be in service as early as December 2016.

“This is an important collaboration between Gulf Power, the Navy and the Air Force,” said Stan Connally, Gulf Power president and CEO. “As military installations seek solutions to promote renewable energy generation, we have worked alongside our military customers to help provide cost-effective solutions — and all our customers will reap the benefit.”

This is Gulf Power’s second alternative energy project since launching the 3.2-megawatt Perdido Landfill Gas-to-Energy facility in 2010. Together, these new solar facilities, which will be developed by HelioSage Energy, could produce enough energy to power approximately 18,000 homes for one year.

“We’re excited to be able to add solar energy to our generation mix,” Connally said. “With some careful planning, we’ve been able to make sure these projects are cost-effective for our customers.”

“We’re excited to be able to add solar energy to our generation mix,” Connally said. “With some careful planning, we’ve been able to make sure these projects are cost-effective for our customers.”

Once approved by the FPSC, the solar energy farms will be constructed at Eglin AFB in Fort Walton Beach (30 megawatts), Holley Field in Navarre (40 megawatts) and Saufley Field in Pensacola (50 megawatts). Gulf Power will serve customers across Northwest Florida with power from these renewable energy-generating facilities.

Capt. Keith Hoskins, commanding officer of NAS Pensacola, said the project is part of the Secretary of the Navy’s Strategy for Renewable Energy and provides an opportunity to assist local and state industry partners in understanding the Department of the Navy’s overall strategy and commitment to renewable energy.

“This project will provide a potential benefit to the U.S. Navy in providing energy security during outages to allow seamless operation of our critical assets,” Hoskins said.

NAS Whiting Field’s commanding officer Capt. Todd A. Bahlau addressed the benefits of the solar projects.

“NAS Whiting Field is excited to participate in the Secretary of the Navy’s plan to invest in renewable energy to diversify the Navy’s energy sources,” Bahlau said. “This is a win-win for everyone involved and another example of the tremendous partnerships between the military and the leaders of Northwest Florida.”

The Air Force, also striving to meet new federal renewable energy and energy conservation goals, is excited to get the project started.

“This project helps meet the DoD goal of 25 percent renewables by 2025 and the Air Force’s energy goal of 1 gigawatt of on-site capacity by 2016,” said Brig. Gen. David Harris, 96th Test Wing commander.

The Air Force Civil Engineer Center’s strategic asset utilization division chief Dave Funk highlighted how the solar facilities will not only benefit the community, but will make good use of Air Force property.

“This project exemplifies how a regional utility provider like Gulf Power can effectively partner with the Air Force to achieve common renewable energy and asset-optimization objectives,” Funk said. “The proposed agreement is expected to optimize the value of 240 acres of non-excess Air Force real estate through the development and operation of a ground-mounted solar photovoltaic facility, which will directly benefit Gulf Power, Eglin Air Force Base, and the local community.”

As an intermittent energy resource, the solar farms will not replace Gulf Power’s generation plants, but will have the capability to provide energy that will diversify the power supply and provide a cost-effective alternative during peak energy usage.

Pending FPSC approval, HelioSage is scheduled to begin construction in February 2016.

“HelioSage is excited to partner with Gulf Power on these landmark projects which will bring renewable energy to Northwest Florida,” said Chris Quarterman, vice president of Strategy for HelioSage Energy. “These projects serve as another example that large-scale solar has become a cost-effective technology. We congratulate Gulf Power and the Department of Defense for their leadership and vision, and look forward to working together on this effort.”

Pictured: Examples of HelioSage Energy solar photovoltaic (PV) facilities. Courtesy photos for NorthEscambia.com, click to enlarge.

Man Gets 75 Years For Attempted Murder

January 23, 2015

State Attorney Bill Eddins announced Thursdayday that Trevor Jerrod Jones was sentenced to 75 years in state prison by Circuit Court Judge Michael Allen. Under Florida’s 10-20-Life law, Jones will serve the sentence day for day.

State Attorney Bill Eddins announced Thursdayday that Trevor Jerrod Jones was sentenced to 75 years in state prison by Circuit Court Judge Michael Allen. Under Florida’s 10-20-Life law, Jones will serve the sentence day for day.

Jones was convicted in October 2014 of attempted first degree premeditated murder and attempted robbery with a firearm. The conviction revolved around the attempted robbery and shooting of Martin White off of Vickie Street in June 2013. Jones lured White into a wooded area before brandishing a firearm and attempting to rob White. As White turned to flee, Jones shot him in the back. Jones was identified by eyewitness identification as well as DNA evidence.

Tate Football Wins Appeal, Moving Down To 1-6A

January 23, 2015

According to the Tate High football program, the Florida High School Athletic Association has approved the school’s classification appeal — moving the school from 1-7A down to 1-6A.

Under tentative four-year classifications released in December by the FHSAA, Tate was in 1-7A with Niceville, Navarre and three Tallahassee schools – Chiles, Leon and Lincoln. The school appealed, citing financial travel restraints due to travel distances.

The Aggies were reclassified to District 1 Class 6A with Escambia, Washington, Pine Forest, Milton and Pace.

NorthEscambia.com file photo.