Ernest Ward Honors Veterans (With Gallery)

November 7, 2015

Ernest Ward Middle School paused to honor veterans from the across the area Friday morning.

During an emotional display. the students prepared a small, white table with a place setting for one in front of an empty black chair. The ceremony represented the never-ending hope for the return of MIA soldiers. The program also included patriotic music, an armed forces salute and the presentation of colors from the Northview High School NJROTC.

During an emotional display. the students prepared a small, white table with a place setting for one in front of an empty black chair. The ceremony represented the never-ending hope for the return of MIA soldiers. The program also included patriotic music, an armed forces salute and the presentation of colors from the Northview High School NJROTC.

Students also presented “Moments in Time” — reading the personal stories submitted by local veterans.

The families of veterans Joel Day and Elmer Neal were presented patriotic wreaths in their memories.

NorthEscambia.com photos, click to enlarge.

Ransom Middle Students Hold Mock Election

November 7, 2015

Seventh grade students at Ransom Middle school had a real-world lesson on voting Friday, using real-world voting equipment, and voted on their choice for the next president.

Ransom Civics teacher Lauren Samoszenko teamed up with David Stafford and the staff of the Supervisor of Elections Office to create a real election experience for her students. They voted using real ballots and voting machines.

For simplicity, four candidates were listed on the ballot — the top two polling Republicans top two Democrats at the time the ballots were printed. Students voted for Ben Carson for president almost two to one over the other three candidates. Results were as follows:

- Ben Carson 186

- Donald Trump 94

- Hillary Clinton 59

- Bernie Sanders 41

- Write-in 2

Students also voted on a proposed constitutional amendment regarding voter registration. If passed, the amendment would restore the voting rights of Floridians with felony convictions after they complete all terms of their sentence, including parole or probation. Those convicted of murder or severe offenses would not have their voting rights restore. Ransom students voted to approve the amendment, 244-140.

Students also voted on a proposed constitutional amendment regarding voter registration. If passed, the amendment would restore the voting rights of Floridians with felony convictions after they complete all terms of their sentence, including parole or probation. Those convicted of murder or severe offenses would not have their voting rights restore. Ransom students voted to approve the amendment, 244-140.

In a local “school question”, 362 students indicated that they have internet access at home while 22 indicated that they do not.

“We chose this question because we are moving toward becoming a one-to-one technology district,” explained Samoszenko. “Here at Ransom Middle, we aren’t one-to-one yet, but we want to know what we’re getting into when we finally get there.”

David Stafford, Escambia County’s Supervisor of Elections, was on site and worked with the students. “The process is very similar to what their parents and teachers will experience next year when they go to the polls to vote for the presidential election. They’re checking in, they’re getting a paper ballot, they’re taking it to a voting booth and getting it tabulated on literally the same voting equipment that will be used during the next presidential election.”

“We’ve found that the earlier we get students involved and get them used to the process, the more likely they are to participate when they reach voting age, added Stafford.

Photos by Kim Stefansson and Brandy Ziglar for NorthEscambia.com, click to enlarge.

Escambia Man Charged With First Degree Murder Of Infant

November 7, 2015

An Escambia County man is behind bars charged with the death of a four-month-old.

Christopher Demitchie Harris is charged with first degree murder not premeditated in the death of Jehmier Booker. Booker was pronounced deceased after paramedics were called to a home located in the 300 block of Teakwood Circle on May 22, 2015.

Christopher Demitchie Harris is charged with first degree murder not premeditated in the death of Jehmier Booker. Booker was pronounced deceased after paramedics were called to a home located in the 300 block of Teakwood Circle on May 22, 2015.

Booker and his three-year-old sibling had been left in the care of Harris for approximately 11 hours while their mother was away.

The cause of death was ruled as blunt force trauma.

Escambia County Weekly Traffic Alerts

November 7, 2015

Drivers will encounter traffic disruptions on the following state roads in Escambia and Santa Rosa counties as crews perform construction and maintenance activities.

- U.S. 98 Resurfacing, Santa Rosa County – U.S. 98 between Live Oaks Village shopping center and the Gulf Breeze Zoo in Santa Rosa County. Alternating lane closures from 9 p.m. Friday, to 7 a.m. Saturday and between 7 p.m. and 7 a.m. Saturday through Nov. 12. Crews will be placing the final layer of asphalt on the roadway and completing work list items.

- U.S. 98 (Garden Street) and Bruce Street Intersection, Escambia County- Lane closure at the intersection from 8 p.m. Sunday to 2 a.m. Monday as crews perform routine maintenance work.

- State Road (S.R.) 196 (Bayfront Parkway), S.R. 10A (Cervantes/Scenic Highway), S.R. 752 (Texar Drive), S.R. 95 (Palafox Street), U.S. 98 (Garden Street), S.R. 292 (Pace Boulevard), Escambia County – The Pensacola Marathon will be held from 6:30 a.m. to 12:30 p.m. along the following state routes in Escambia County. Drivers are encouraged to seek an alternate route:

- Bayfront Pkwy heading east from Ninth Avenue to 17th Avenue.

- Cervantes/Scenic Highway heading East/North from 17th Avenue to Summit Boulevard.

- Texar Drive heading West from Ninth Avenue to Palafox Street.

- Palafox Street heading south from Texar Drive to Garden Street.

- Garden Street heading west to Pace Boulevard.

- Pace Boulevard heading south to Barrancas Street.

- Interstate 10 (I-10) Six Lane, Escambia County – I-10 between Davis Highway (Exit 13) and Scenic Highway (Exit 17) traffic in Escambia County, will encounter alternating lane closures from 8 p.m. to 6:30 a.m. the week of Monday, November 9. The closures will allow crews to shift traffic to the outside to begin widening work in the median.

- I-10 Six Lane, Santa Rosa County – I-10 east and westbound between the Escambia Bay Bridge and S.R. 281 (Avalon Boulevard) in Santa Rosa County. Alternating lane closures Sunday through Thursday through the end of 2015. Lane closures will be in effect from 8 p.m. to 6 a.m. as crews perform construction activities.

- U.S. 98 (Garden Street) in Escambia County- Lane closures will take place on Garden Street as crews clean and video sanitary sewer lines on the following:

- Monday from 8 p.m. to 10 p.m.

- Garden Street eastbound outside lane closure at Baylen Street.

- Garden Street westbound inside lane closure at Baylen Street.

- Tuesday from 12 a.m. to 4 a.m.

- Garden Street outside lane closure at Baylen Street.

- Monday from 8 p.m. to 10 p.m.

- S.R. 87, Santa Rosa County – The city of Milton will hold their Veterans Day parade Wednesday. S.R. 87 between Raymond Hobb Street and Berryhill Street will be closed to traffic between 9:30 a.m. and 11 a.m. Drivers may seek an alternate route.

- I-10 Escambia Bay Bridge, Escambia County- Alternating east and westbound outside and inside lanes restrictions Tuesday through Friday. Lane closures will be in effect 8 p.m. to midnight as crews repair highway lighting.

- U.S. 98 Pensacola Bay Bridge Escambia/Santa Rosa County- Alternating outside lanes restrictions Tuesday through Friday. Lane closures will be in effect 8 p.m. to 5 a.m. as crews repair highway lighting.

- I-110 at Fairfield Drive and Maxwell Street Exit ramps, Escambia County. Lane shift Wednesday on the Fairfield Drive off ramp (Exit 4) and Thursday Maxwell Drive off ramp (Exit 3) as crews refurbish reflective pavement markings.

- Nine Mile Road from west of I-10 to Heritage Oaks Drive, Escambia County – Eastbound and westbound lane closures from 8 p.m. to 6 a.m. beginning Thursday through Nov. 22 as crews perform paving operations.

- I-110 Bridge Painting – Drivers may encounter intermittent daytime restrictions on city streets under I-110 between Maxwell and Garden Streets as crews clean the bridges. The $2.6 million rehabilitation project is anticipated to be complete summer 2016.

Drivers are reminded to use caution, especially at night, when traveling through a work zone. All planned construction activities are weather dependent and may be rescheduled in the event of inclement weather.

Friday Night Football Finals

November 7, 2015

Here are final Friday night football scores from around the North Escambia area, including playoffs in Alabama. (Additional scores will be added as games end.)

FLORIDA

- South Walton 59, Jay 26

- Trinity Christian 32, Pine Forest 22

- Arnold 44, Milton 29

- Pace 35, Catholic 13

- Navarre 35, Niceville 13

- Crestview 27, Gulf Breeze 24 OT

- Escambia 17, Pensacola 6

- Washington 56, West Florida 42

ALABAMA PLAYOFFS

- Lee Scott Academy 35, Escambia Academy 24

- Flomaton 26, New Brockton 20 FINAL

- T.R. MIller 67, Central Coosa 17

- Munford 20, W.S. Neal 0

Scott Pitches Business Friendly Tax Cuts

November 7, 2015

Gov. Rick Scott, who has already asked lawmakers for $250 million that could be used to lure corporations to Florida, rolled out a proposed $1 billion tax-cut package on Thursday.

A Democratic leader decried the tax-cut proposal as a way of gutting state government programs, while a key Republican lawmaker called the requested cuts “bold.”

The bulk of the proposed cuts, which would be amassed over a two-year period, involve permanently eliminating the income tax on manufacturing and retail businesses, a cut the governor’s office estimates at $770 million.

The package also would make permanent the elimination of a tax on manufacturing equipment, reduce a commercial lease tax and extend a temporary elimination of sales taxes on college textbooks.

The package also would make permanent the elimination of a tax on manufacturing equipment, reduce a commercial lease tax and extend a temporary elimination of sales taxes on college textbooks.

Scott said in a news release that the tax cut package is “putting job creators on the road to success for years to come.”

“The more we can cut taxes — like the one on commercial lease — the more we can grow our small businesses in Florida and further diversify our economy to invest in our future,” Scott said.

For most Floridians, the cuts will be seen through a pair of sales tax “holidays,” which total just over $70 million. A 10-day back-to-school “holiday” would lift sales taxes on certain school supplies, clothes and some electronics. A separate nine-day period would be set aside to remove sales tax on hurricane supplies.

House Minority Leader Mark Pafford, D-West Palm Beach, said fulfilling Scott’s request would require spending cuts to areas such as the environment and education.

“So we have services that are responsive to the people of Florida, he’s gutting them,” Pafford said. “He’s continuing to move and follow through on his pledge of smaller government. And that pledge is destroying Florida and eating up reserves, paying no attention to what his own agencies are claiming will happen.

“His legacy is going to catch up to him,” Pafford added. “Gov. Scott has led us in to the dark ages and under his control we’re not going to see a renaissance.”

The call for the cuts comes as state economists in September projected lawmakers will have a $635.4 million surplus when crafting the budget for the next fiscal year. In addition to seeking the tax cuts, Scott is pushing for $250 million in economic-development incentive money.

House Finance & Tax Chairman Matt Gaetz, R-Fort Walton Beach, called Scott’s tax-cut proposal “bold.” Gaetz’s committee will work on a final tax-cut package during the legislative session that starts in January.

“Who says you should only cut taxes in an amount that equates to the surplus?” Gaetz said. “Some of us believe you should actually shrink the size of government.”

Gaetz said he’s also encouraged that the governor included reducing the commercial lease tax, which the committee chairman said is a personal priority.

“We’re already seeing the governor reflect priorities of the House in his tax plan, and we’ll do all that is appropriate to vet the proposals he’s put forward and determine what impact they’ll have on Florida’s expanding economy,” Gaetz said.

Senate President Andy Gardiner, who in September said $250 million would be a starting point in discussions on tax cuts, “would certainly support increasing that amount provided we can maintain the structural balance within our budget,” spokeswoman Katie Betta said in an email Thursday.

A number of the proposals are already moving in the Senate.

Proposals for a 10-day sales tax holiday on back-to-school items (SB 198) and to reduce the tax on commercial leases from 6 percent to 5 percent (SB 116) have each gone through two Senate committees without finding any opposition.

The state Revenue Estimating Conference estimates the “back-to-school tax holiday” could save shoppers $68.7 million, cutting state revenue by $56.1 million and local government revenue by $12.6 million.

Reducing the commercial lease tax by a single percentage point is projected to reduce state and local government revenue by $199.6 million next fiscal year, with the amount growing to $287 million. The reduction would go into place Jan. 1, 2017, which is in the middle of next fiscal year.

Scott announced the proposed tax-cut package at the annual Manufactures Association of Florida Summit in West Palm Beach. He had earlier called for making the manufacturing-equipment tax cut permanent.

Lawmakers in 2013 approved a three-year moratorium on the manufacturing-equipment tax, but the tax is scheduled to be revived in 2017. Scott last year projected that companies will have to pay $142.5 million annually if the tax returns.

Cutting the commercial-lease tax is a priority for a number of business groups.

The conservative-advocacy group Americans for Prosperity-Florida, which considers reducing the commercial lease tax a top priority, wasted little time calling on lawmakers to work with Scott on his proposed cuts. Also, the group reiterated its opposition to requests to fund professional sports stadiums in Miami, Jacksonville, Tampa and Daytona Beach or to create incentives for the film and television industry.

“While legislators and the governor are making great strides to reduce burdens such as the commercial lease sales tax on Florida families and businesses, they should be working to eliminate taxes that stifle growth and competition all together,” AFP-Florida State Director Chris Hudson said in a release.

Throughout his nearly five years in office, Scott has made a top priority of cutting taxes.

As he ran for re-election in 2014, Scott campaigned on a promise of $1 billion in tax cuts over a two-year period. Lawmakers put together a wide-ranging tax-cut package during a June special session that is projected by state economists to cut revenue by $372.4 million this fiscal year.

by Jim Turner, The News Service of Florida

Over A Month After Homeless Story Goes Viral, Steve Has Been Found

November 6, 2015

Remember Steve the homeless man? He’s been found again and plans are underway to help him make it through the winter.

In late September, NorthEscambia.com published a story about John Brantley, an Atmore elementary school principal, and his encounter with Steve outside a Best Buy store in Mobile. The story of Steve went viral, viewed well over a million times.

It all began when Brantley snapped a photo of Steve, on his knees digging through a trash can looking for bits of food.

It all began when Brantley snapped a photo of Steve, on his knees digging through a trash can looking for bits of food.

Offers poured in from around the country to help Steve….except Brantley and others were not able to find him again. Until Thursday night.

“I had a long conversation with Steve tonight and he has agreed to be helped,” Brantley wrote in a Facebook post. “I have set up this gofundme account to help raise money for Steve a place to stay this winter as well as helping him with basic essentials and ultimately helping him get back on his feet.”

To read our original story about Steve and Brantley’s encounter with him, click here.

To visit the gofundme page and donate to help Steve, click here.

Court Strikes Down Law On Credit Card Surcharges

November 6, 2015

Pointing to the First Amendment, a federal appeals court has struck down a Florida law that bars businesses from imposing a “surcharge” on customers who pay with credit cards.

The 11th U.S. Circuit Court of Appeals, in a 2-1 decision Wednesday, sided with four small businesses that faced potential prosecution for telling customers they would face additional costs for using credit cards.

A key part of the ruling focused on part of Florida law that allows businesses to offer discounts to customers who pay with cash — but bars surcharges for credit-card transactions. Judge Gerald Tjoflat wrote that the First Amendment “prevents staking citizens’ liberty on such distinctions in search of a difference.”

A key part of the ruling focused on part of Florida law that allows businesses to offer discounts to customers who pay with cash — but bars surcharges for credit-card transactions. Judge Gerald Tjoflat wrote that the First Amendment “prevents staking citizens’ liberty on such distinctions in search of a difference.”

“Tautologically speaking, surcharges and discounts are nothing more than two sides of the same coin; a surcharge is simply a ‘negative’ discount, and a discount is a ‘negative’ surcharge,” Tjoflat wrote in the 30-page ruling, joined by Judge David Bryan Sentelle. “As a result, a merchant who offers the same product at two prices — a lower price for customers paying cash and a higher price for those using credit cards — is allowed to offer a discount for cash while a simple slip of the tongue calling the same price difference a surcharge runs the risk of being fined and imprisoned.”

But Chief Judge Ed Carnes wrote a stinging dissent, contending that a state law was “being struck down by a federal court for no good reason.”

Carnes described a scenario in which a store could put a $100 sticker price on an item and surprise a customer at the cash register by charging $103 because of a credit-card surcharge.

“It does not matter whether the store characterizes the difference in price as a credit card surcharge, a cash discount, or both,” Carnes wrote. “The merchant can speak in any way he chooses so long as he does not ambush the credit-card-using customer with a higher price at the register. What matters is when, from the customer’s perspective, the merchant adds the additional amount to the price because a credit card is used, not how the merchant describes it.”

The majority overturned a ruling by a federal district judge, who last year agreed with arguments made by Attorney General Pam Bondi’s office and dismissed the case.

The lawsuit was filed in 2014 by four businesses that had received “cease-and-desist” letters from the state related to alleged violations of the credit-card surcharge law, according to the appeals-court ruling. The businesses were Dana’s Railroad Supply in Spring Hill, TM Jewelry LLC in Key West, Tallahassee Discount Furniture in Tallahassee and Cook’s Sportland in Venice.

The credit-card surcharge law says violators can face second-degree misdemeanor charges.

“Based on the belief that it is more effective, transparent, and accurate to do so, all four of the businesses wish to call the price difference a credit-card surcharge rather than a cash discount,” Tjoflat wrote.

In the dissent, Carnes said government can regulate “economic conduct” without violating constitutional free-speech rights. He wrote that “a surcharge openly posted on the store shelf is permissible, while one that comes up for the first time when the customer is paying for her purchase is not. Prescribing when a business can add an additional amount to its price controls the timing of conduct and not the speech describing that conduct. The Supreme Court has long held that the government can regulate economic conduct — including the prices charged by merchants — without violating the First Amendment.”

by Jim Saunders, The News Service of Florida

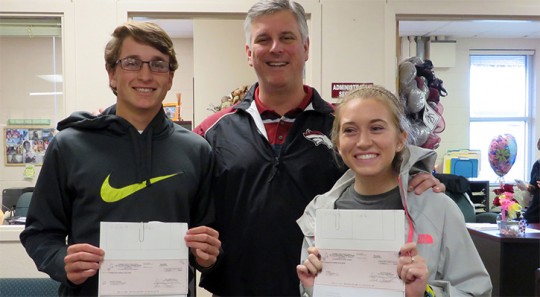

Tate Names Students Of The Month

November 6, 2015

Tate High School has named October students of the month. They are Ian Ruiz and Madison Nelson, pictured with Principal Rick Shackle. Courtesy photo for NorthEscambia.com, click to enlarge.

Escambia Man Charged With Sex Assault, Kidnapping

November 6, 2015

An Escambia County man has been arrested for kidnapping and sexual assault.

Tristan Maurice Richey, 29, was charged for the October 23 incident. At about 4 p.m. on that date, deputies responded to Baptist Hospital in reference to a sexual battery that had just occurred. The victim told deputies that she was getting into her vehicle when the suspect, that she personally knew as Richey, pointed a gun at her and demanded that she get into her vehicle.

Tristan Maurice Richey, 29, was charged for the October 23 incident. At about 4 p.m. on that date, deputies responded to Baptist Hospital in reference to a sexual battery that had just occurred. The victim told deputies that she was getting into her vehicle when the suspect, that she personally knew as Richey, pointed a gun at her and demanded that she get into her vehicle.

Richey then drove the victim to a house located on Flaxman Street and sexually battered her.

Richey is charged with aggravated assault, kidnapping, possession of a weapon by a convicted felon and sexual assault. He was arrested Thursday and booked into the Escambia County Jail with bond set at $1.4 million.