Cross Country: Northview, Flomaton, PCA, Central

September 26, 2018

Northview, Pensacola Christian, Flomaton and Central took part in a cross country meet on a rainy Tuesday afternoon at Northview High School in Bratt.

For a photo gallery, click here.

1st — Pensacola Christian

2nd — Northview

Boys

1st — Pensacola Christian

2nd — Northview

3rd — Flomaton

No girls from Flomaton took part. Century ran individual male and female athletes but did not field full teams.

NorthEscambia.com photos, click to enlarge.

Big Money Backs Gambling, Dog Racing And Other Florida Ballot Measures

September 26, 2018

Florida voters this fall could decide the fate of 12 ballot proposals that deal with issues ranging from limiting taxes to banning greyhound racing.

Behind the scenes, businesses and organizations have already spent tens of millions of dollars as they try to pass — or defeat — some of the proposed constitutional amendments.

Here are snapshots of five ballot proposals that are drawing big chunks of money:

MARSY’S LAW: Part of a national movement to boost crime victims’ rights, Amendment 6 on the November ballot had already drawn $30.37 million as of Sept. 14.

The amendment, put on the ballot by the Florida Constitution Revision Commission, is dubbed “Marsy’s Law” and is rooted in the 1983 death of a California woman, Marsy Nicholas, who was stalked and killed by an ex-boyfriend. Marsy Nicholas’ brother, Henry, is the co-founder of Broadcom Corp. and has spearheaded the Marsy’s Law movement.

Almost all of the money backing the Florida measure, $30.045 million, has come from the national Marsy’s Law for All Foundation, according to the state Division of Elections website. Another $325,000 has come from Henry Nicholas.

GAMBLING BATTLE: Amendment 3, which is designed to make it harder to expand gambling in the state, has drawn millions of dollars from supporters and opponents. Disney Worldwide Services, Inc. and the Seminole Tribe of Florida have combined to contribute $26.43 million to the political committee Voters In Charge, which led a petition drive to get the measure on the ballot and is steering efforts to pass it.

Disney is a longtime opponent of casino gambling, while the Seminole Tribe already operates lucrative casinos in Florida. The ballot proposal would change the Florida Constitution and give voters the “exclusive right to decide whether to authorize casino gambling” in the state. If approved, it would require voter approval of casino-style games in the future and effectively reduce the power of the Legislature and governor to decide gambling-related issues.

The gambling industry, however, has started funneling money to at least two political committees to fight the ballot proposal. One of those committees, known as Citizens for the Truth About Amendment 3, had raised $3.52 million as of Sept. 14, while another, known as Vote NO on 3, had raised $650,000.

FELONS VOTING: Restoring the voting rights of felons has long been a contentious legal and political issue in Florida.

But buoyed by money from the American Civil Liberties Union and a series of other large donors, the political committee Floridians for a Fair Democracy is seeking to pass a proposed constitutional amendment, known as Amendment 4, that would automatically restore the rights of most felons after they serve their sentences, complete parole or probation and pay restitution. The amendment would not apply to people convicted of murder or sexual offenses.

Floridians for a Fair Democracy had raised $14.4 million as of Sept. 14 to get the measure on the ballot and to try to pass it. The ACLU had contributed $3.8 million in cash and had made hundreds of thousands of dollars in in-kind contributions.

TAX CAP CONTINUATION: Voters in 2008 approved a constitutional amendment that placed a 10 percent cap on annual increases in assessed values of non-homestead properties, such as commercial properties. But the limit will expire Jan. 1 unless it is extended by voters in November through the passage of Amendment 2.

Lawmakers placed Amendment 2 on the ballot, along with two other measures — Amendment 1 and Amendment 5 — aimed at cutting or holding down taxes.

The industry group Florida Realtors is trying to make sure Amendment 2 passes. As of Sept. 14, the group had contributed $5.56 million to a political committee known as Amendment 2 is for Everybody, according to the Division of Election website.

GREYHOUND RACING: Animal-rights groups have tried for years to convince lawmakers to stop greyhound racing in Florida.

But unable to get legislation passed, they enlisted the support of the Constitution Revision Commission, which approved placing a measure on the ballot designed to ban dog racing at pari-mutuel facilities.

An effort known as the Committee to Protect Dogs had raised about $2.3 million as of Sept. 14 to bolster efforts to pass the amendment, with $1.5 million coming from the Doris Day Animal League. The group Grey2K USA had added more than $480,000.

by Jim Saunders, The News Service of Florida

Broxson Tours Beulah Middle School

September 26, 2018

State Sen. Doug Broxson joined Escambia School Superintendent Malcolm Thomas and School Board member Kevin Adams in touring the new Beulah Middle School Tuesday. Courtesy photos for NorthEscambia.com, click to enlarge.

Man Dies In Crash While Fleeing From Escambia County Deputy

September 25, 2018

A man fleeing from deputies died in a traffic crash early Tuesday morning in Escambia County.

The Escambia County Sheriff’s Office was attempting to stop a Hyundai Elantra driven by 20-year old Micheal Ozarius Crumpton on Palafox Street when he fled from deputies, according to the Florida Highway Patrol. While continuing to flee, Crumpton ran a red light at the Fairfield Drive intersection, striking a Chevrolet Silverado driven by 22-year old Shyanne Nicole Doster. The Silverado overturned and struck a Toyota pickup driven by Edward Glenn King of Cantonment.

Crumpton was ejected. He was transported to Baptist Hospital where he was pronounced deceased.

Doster and King were not injured.

The Florida Highway Patrol is continuing their investigation.

Photos by Kayla Mott for NorthEscambia.com, click to enlarge.

Century Man Charged With Aggravated Assault With A Deadly Weapon

September 25, 2018

A Century man was arrested for allegedly pulled a gun on a man and threatening to kill the man’s friend.

Aaron Lee Sutton, 29, was arrested Saturday in connection with the incident on September 6 on Crary Road . He was charged with felony aggravated assault with a deadly weapon and misdemeanor battery.

The victim told deputies that he was walking home when Sutton stopped and offered him a ride to the home he shares with a friend. When they arrived, Sutton reached into his vehicle center console and retrieved a pistol, according to an Escambia County Sheriff’s Office arrest report, before running toward the door yelling that he was going to kill the victim’s friend.

The victim told deputies that he was walking home when Sutton stopped and offered him a ride to the home he shares with a friend. When they arrived, Sutton reached into his vehicle center console and retrieved a pistol, according to an Escambia County Sheriff’s Office arrest report, before running toward the door yelling that he was going to kill the victim’s friend.

Sutton allegedly grabbed the man by the throat and pointed the gun at his face before driving away “yelling and screaming” that he was going to kill his friend inside the home, the report states.

The friend told deputies that he saw Sutton beating on the door of the home with a firearm and observed him grab the other victim, but he said he did not see Sutton point the firearm at the victim, according to the ECSO.

The victim did not report the alleged incident for two days.

Sutton was released from jail on a $6,000 bond.

Escambia Sheriff’s Office K-9 Team Places At National Field Trials

September 25, 2018

The Escambia County Sheriff’s Office K-9 Team earned two big wins recently at the United States Police Canine Association’s National Patrol Dog Field Trials.

During the Four-Man Department Team Competition, Escambia County’s Deputy J. Marcum and K-9 Benga, Deputy J. Rogers and K-9 Axel, Deputy M. Watkins and K-9 Bady, and Deputy J.R. Reaves and K-9 Alek took third place.

Master Deputy Wayne Gulsby and K-9 Enzo won 15th place overall out of 85 teams.

Photos for NorthEscambia.com, click to enlarge.

DUI Driver Gets Life For Crash That Kill Two Sisters In Pace

September 25, 2018

A Santa Rosa County man was sentenced to life in prison Monday for the DUI manslaughter death of two girls in Pace.

Kailen Kelly, age 35 of Pace, was traveling at a high rate of speed May 6 when he crossed into another lane on Woodbine Road and slammed his 2008 Ford pickup head-on into a 2010 Buick driven by 39-year old Melanie Harrell of Pace. . Stormie P. Harrell, 7, and Michaela D. Sidney, 17, were killed. Melanie Harrell and 18-year old McKenzie Murphy were injured.

Kailen Kelly, age 35 of Pace, was traveling at a high rate of speed May 6 when he crossed into another lane on Woodbine Road and slammed his 2008 Ford pickup head-on into a 2010 Buick driven by 39-year old Melanie Harrell of Pace. . Stormie P. Harrell, 7, and Michaela D. Sidney, 17, were killed. Melanie Harrell and 18-year old McKenzie Murphy were injured.

Kelly’s license was suspended until April 2018 — reinstated just days before the crash — after he refused to submit to a DUI test in Okaloosa County in 2017. His past includes threatening a person with a firearm and discharging a firearm in Escambia County and two prior DUI convictions.

He had a blood alcohol level of .149, had marijuana in his system and refused a breath test after the double fatal crash May 6, according to testimony. He showed no remorse, and a 12 pack of beer was found in his truck.

Kelly was charged with two counts of DUI-vehicular manslaughter, DUI with serious bodily injury to another, refusing to submit to a DUI test after license suspension, reckless driving, fleeing/eluding police and other traffic offenses.

Pictured top: Kelly’s vehicle following a double fatal crash. Submitted photo for NorthEscambia.com, click to enlarge.

Santa Rosa Farm Families Recognized For Environmental Leadership

September 25, 2018

Three Santa Rosa-based farmers and ranchers were honored for their environmental stewardship with a County Alliance for Responsible Environmental Stewardship (CARES) award recently at the Jay Civic Center.

Recipients honored were Alan Edwards of Alan Edwards Farms, Tyler Brown of Brown Farms and Trent Mathews of Sweet Season Farms.

Alan Edwards is a fifth-generation farmer who farms cotton, soybeans, peanuts, wheat, hay and raises beef cattle. Tyler Brown is a first-generation cotton and peanut farmer. Trent Mathews raises cattle and grows row crops and owns an Agri-tourism operation, Sweet Season Farms.

The CARES program was established by Florida Farm Bureau and the Suwannee River Partnership in 2001 to recognize superior natural resource conservation by agricultural producers. The program relies on action by farmers and ranchers to implement state-of-the-art natural resource management systems, or Best Management Practices, on their properties.

“Florida’s farmers and ranchers answer the call to protect our environment while also producing our food supply,’ said Florida Farm Bureau CARES Coordinator Cacee Hilliard. “Demonstrating outstanding efforts to implement practices that reduce water and nutrient use and also improve water quality earn an agricultural producer recognition with a This Farm CARES designation and sign. The customized CARES sign is farmer/rancher’s tool to demonstrate to the general public that they are committed to protecting local natural resources.”

Florida farmers and ranchers depend upon the life-sustaining capacity of the natural resources they manage to maintain their livelihoods. Nearly 800 agriculturists statewide have received the CARES award since the program was established.

In partnership with more than 60 public agencies, including the U.S. Department of Agriculture’s Natural Resource and Conservation Service, the Florida Department of Agriculture and Consumer Services, the University of Florida’s Institute of Food and Agricultural Sciences, the Florida Department of Environmental Protection and Florida’s water management districts, agricultural organizations, businesses and local government, CARES has become a model for the rest of the nation.

Pictured: Awards presented Alan Edwards (top), Tyler Brown (below) and Trent Mathews (bottom). Photos for NorthEscambia.com, click to enlarge.

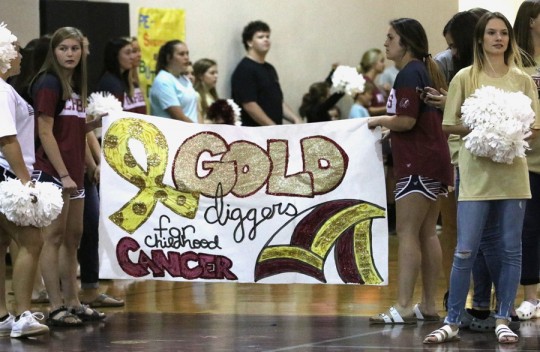

NHS Beats Lighthouse In ‘Gold Diggers’ Game For Childhood Cancer

September 25, 2018

The Northview Lady Chiefs defeated Lighthouse Christian in three quick sets Monday in Bratt in a game that benefit childhood cancer awareness.

The Northview Lady Chiefs defeated Lighthouse Christian in three quick sets Monday in Bratt in a game that benefit childhood cancer awareness.

The Chiefs won three straight 25-8, 25-7, 25-1.

Proceeds from the “Gold Diggers” game will benefit the Childhood Cancer Organization. Award winners from a recent Northview Lady Chief volleyball game were also recognized (see photo below).

Tuesday, the Northview Lady Chiefs will travel to Laurel Hill.

NorthEscambia.com photos, click to enlarge.

Class Action Lawsuit Rejected On Property Insurance Costs

September 25, 2018

A divided federal appeals court Monday rejected class-action lawsuits filed by Florida homeowners who said they were charged too much for property insurance after leaving it to mortgage companies to buy coverage.

The ruling by a three-judge panel of the 11th U.S. Circuit Court of Appeals dealt with what is known as “force-placed insurance,” which occurs when people with mortgages do not buy property-insurance coverage. Lenders then buy coverage and pass along the costs to the borrowers.

Four Florida residents and a Pennsylvania resident filed class-action lawsuits in 2015 against two mortgage-servicing companies and American Security Insurance Co., alleging a scheme that led to inflated charges for force-placed insurance. At least in part, they alleged that Specialized Loan Servicing, LLC and Caliber Home Loans, Inc. received rebates from American Security Insurance, the force-placed insurer, but didn’t pass along those savings to the borrowers, according to Monday’s ruling.

The lawsuits, which became consolidated, included a series of allegations, including breach of contract, racketeering, violation of the Federal Truth in Lending Act and violation of the Florida Deceptive and Unfair Trade Practices Act.

But the appeals court, in a 28-page majority opinion, upheld decisions by a U.S. district judge in South Florida to dismiss the cases. The opinion centered on state regulators approving the rates charged by American Security Insurance — and a legal concept, known as the filed-rate doctrine, that seeks to keep courts out of rate-making decisions.

“The plain language of the complaints … shows that the plaintiffs are challenging the reasonableness of ASIC’s (American Security Insurance’s) premiums; and since these premiums are based upon rates filed with state regulators, plaintiffs are directly attacking those rates as being unreasonable as well. … Because the plaintiffs should be understood as meaning what they say, we find that they have challenged ASIC’s filed rate. As such, there can be no doubt that their causes of action are barred by the filed-rate doctrine,” said the majority opinion, written by Judge Danny J. Boggs and joined by Judge Frank Hull.

But Judge Adalberto Jordan wrote a 36-page dissent that said the federal appeals court should send the issue to the Florida Supreme Court and the Pennsylvania Supreme Court for guidance about how the states view the filed-rate doctrine. He also took issue with the majority’s interpretation of the facts in the cases.

“ASIC and the lenders argue that the filed rate doctrine bars the homeowners’ claims because they amount to generalized grievances that ASIC’s insurance rates are unreasonably high, and seek only to force the defendants to sell (in ASIC’s case) or bill for (in the lenders’ case) insurance at lower rates,” Jordan wrote. “But that argument misreads the homeowners’ claims. The homeowners assert that, regardless of the insurance rate ASIC charged, the lenders are contractually obligated to charge only the amount of insurance they actually paid. By engaging in side agreements with ASIC for ‘commissions,’ ‘reinsurance,’ and other kickbacks — transactions that are of course, unregulated — the lenders found a way to discount their insurance costs. Given that the mortgage contracts between the homeowners and the lenders required the lenders to charge the homeowners for only ‘the cost’ of insurance, the lenders breached those contracts by demanding more than the discounted cost they paid ASIC.”

by Jim Saunders, The News Service of Florida