Firefighters Battle Large Swift Lumber Blaze (With Photo Gallery)

May 22, 2011

Firefighters from across the area battled a large fire at Swift Lumber in Atmore Sunday afternoon.

Black smoke from the lumber mill fire could be seen from as far away as Walnut Hill just before 3 p.m. Dozens of firefighters from Atmore, Poarch, Nokomis, Flomaton and Walnut Hill battled for hours to completely contain the fire. The major portion of the fire was extinguished within about an hour, but wood chips continued to smolder and burn for hours.

There were no reports of injuries. There was no immediate word on the cause of the fire.

For a NorthEscambia.com photo gallery from the scene, click here.

This was the second fire in the same area of the facility on Swift Mill Road in less than six months. Another fire broke out at the facility in early January of this year; that fire was believed to have been caused by an electrical problem.

Pictured: A Sunday afternoon fire at Swift Lumber in Atmore. NorthEscambia.com photo, click to enlarge.

Three Injured In Highway 29 Rollover Crash (With Photo Gallery)

May 22, 2011

Two Cantonment residents were trapped in single vehicle rollover accident shortly after 8:00 Sunday morning on Highway 29 at Woodland Avenue in Cantonment.

The Florida Highway Patrol says Kenneth Bedwell, 51, was northbound on Highway 29 at Woodland Avenue when he traveled partially off the roadway onto the northbound shoulder. He then over-corrected and swerved into the median where his 2005 Buick SUV began to overturn. The vehicle came to rest upside down on Highway 29.

Firefighters were forced to use the Jaws of Life to extricate a Bedwell and his passenger, 52-year old Mary Bedwell of Cantonment. Kenneth Bedwell was airlifted to Sacred Heart Hospital in critical condition. Mary Bedwell was transported by ambulance to Sacred Heart Hospital where she was listed in serious condition.

A toddler properly secured in car seat in the vehicle, three-year old Alphonsa Griffin of Cantonment, received only minor injuries and was transported to Sacred Heart Hospital for evaluation.

Charges are pending in the accident, according to the FHP.

The crash, near the Cantonment firehouse, was witnessed D.W. McMillan Hospital EMS crew from Brewton. The Cantonment, Molino and Ensley stations of Escambia Fire Rescue responded to the crash, along with Escambia County EMS and the Escambia County Sheriff’s Office.

For a photo gallery from the scene, click here.

Pictured top: Three people, including a child, were in this single vehicle crash Sunday morning in Cantonment. Pictured inset: Firefighters use the Jaws of Life to free two people from the vehicle. Pictured inset: Highway 29 was shut down in Cantonment due to the crash. NorthEscambia.com photo by Kristi Smith, click to enlarge.

Suspended Sentence For Man That Killed Elderly Couple In Wreck

May 22, 2011

A Brewton man has received a suspended sentence in connection with a 2007 crash that killed an elderly Atmore couple.

George Hauer, 63, received a one-year suspended sentence in Baldwin County Circuit Court, along with two years probation and was also permanently banned from driving in Alabama.

George Hauer, 63, received a one-year suspended sentence in Baldwin County Circuit Court, along with two years probation and was also permanently banned from driving in Alabama.

In the March 20, 2007, wreck, Dwight Eugene Nichols, 74, and his wife Wilma Ellavan Nichols, 77, of Atmore were traveling south in a Mercedes E320 on Highway 31 near Perdido, when they collided with a northbound sports utility vehicle driven by Hauer, according to Alabama State Troopers. Both Nichols died a short time later at an area hospital. Hauer was charged with two counts of vehicular homicide and two counts of manslaughter in connection with that accident. Hauer later pleaded guilty to criminally negligent homicide in connection with the crash.

Hauer was involved in another accident that injured a family of four on March 22, 2009, on Highway 31 east of Flomaton. At the time of the accident, he had been out on a $300,000 bond for only about two weeks after being charged with the death of the elderly Atmore couple.

No charges were ever filed in the Flomaton crash.

The 2009 accident happened on Highway 31 at Old Fannie Road. Officials say the car, driven by David Smith of Flomaton collided with a truck driven by Hauer. Smith was transported to Baptist Hospital by ambulance were he was treated for a broken jaw. Hauer was transported to Sacred Heart Hospital by LifeFlight in serious condition but was soon released from the hospital.

Leigh Smith, a passenger in the car hit by Hauer, was transported by LifeFlight to Baptist Hospital in critical condition. Another passenger in the car, Samantha Bryant, then 0a senior at Flomaton High School, was transported to Baptist Hospital in Pensacola with non life threatening injuries. Passenger Curtis Byrant refused treatment the scene. Leigh Smith was hospitalized for a lengthy time with broken ribs, a broken shoulder and a broken knee.

Pictured top: The Smith family vehicle that was involved in a 2009 accident with George Wesley Hauer. Pictured below: Hauer’s truck. NorthEscambia.com file photos, click to enlarge.

Photos: Parade Honors Veterans, Armed Forces

May 22, 2011

Groups from several communities came together in Atmore Saturday morning for a combined Armed Forces Day and Memorial Day parade.

A sparse crowd lined the streets of Atmore as the Ernest Ward Middle School Band, the Flomaton High School Band, Northview High School NJROTC, a group from the U.S. Navy and Ernest Ward Middle School Drama Team marched along with area veterans.

For a NorthEscambia.com photo gallery from the parade, click here.

The gallery also includes reader submitted photos by Leslie Gonzalez and Cheryl Golson.

Pictured top: The U.S. Navy took part in a combined Armed Forces Day and Memorial Day parade Saturday morning in Atmore. Pictured inset: Danielle Suggs portrays a military widow during the parade on the Ernest Ward Middle School Drama team float. Pictured below: Veterans carry the flags during the parade. NorthEscambia.com photos, click to enlarge.

Tate Grad Takes Part In Vegas Military Band Exhibition

May 22, 2011

The sights and sounds of Las Vegas are generally associated with the casinos, the endless row of hotels on the Strip, and the ads for the new shows being presented.

Somewhere among the organized chaos that has made Las Vegas so famous, the son of a Cantonment couple was adding his own melody to the mix.

Marine Corps Staff Sgt. David L. Morrell, son of Paul and Mary Ann Morrell of N. Highway 95A, Cantonment, was at the Thomas and Mack Center on the UNLV campus with the Marine Corps Air Ground Combat Center Band for the Las Vegas International Tattoo recently.

Marine Corps Staff Sgt. David L. Morrell, son of Paul and Mary Ann Morrell of N. Highway 95A, Cantonment, was at the Thomas and Mack Center on the UNLV campus with the Marine Corps Air Ground Combat Center Band for the Las Vegas International Tattoo recently.

The Las Vegas International Tattoo was a musical exhibition to highlight the armed forces and their allies. In addition to the Marine Corps band, the Navy Band Southwest, Air Force Band of the Golden West, and four Canadian and Scottish military and police bagpipe bands played during the performance. The U. S. Army Drill Team also preformed a precision drill routine during the Tattoo.

Morrell, who plays the saxophone, has had a love of music for most of his life.

“I started playing the saxophone at age ten,” said Morrell, a 1996 graduate of Tate High School, Pensacola. “My dad was a big influence on me to appreciate music.”

Playing music, let alone joining the military, was not the first thing on Morrell’s mind when he thought about his future career choices.

“I just wanted a career in music,” said Morrell, who has been a Marine since 1999.

The Marine Corps Air Ground Combat Center Band preformed and marched to a medley highlighting the creation of our National Anthem and the War of 1812. Morrell and his fellow Marines have been preparing for their performance for several months.

“We spent a couple of months in preparing including a lot of rehearsals,” said Morrell.

Every band played together in an opening sequence, followed by each band or group, in the case of the Army Drill Team and Irish dancers, performing their own sequences before joining all together again for the finale.

The roar of the crowd and the support for the armed forces was enough for Morrell, and the other military performers, to hope for a call next year to return to the festivities.

Pictured top: The Marine Corps Air Ground Combat Center Band performs and marches to a sequence that highlights the War of 1812 and the development of the National Anthem during the 2001 Las Vegas International Tattoo. Pictured inset: Marine Corps Staff Sgt. David L. Morrell is a member of the Marine Corps Air Ground Combat Center Band and recently participated in the Las Vegas International Tattoo, a multi-national military band exhibition that featured not only the Marine Corps band, but other U.S. military and four Canadian and Scottish military and police bagpipe bands. Pictured below: The Marine Corps Air Ground Combat Center Band, Pipes and Drums, 1st Battalion, Scots Guards, and the U. S. Navy Band Southwest perform at the conclusion. Photos by Air Force Tech. Sgt. Sean Worrell for NorthEscambia.com, click to enlarge

Three Jailed After North Santa Rosa Meth Lab Raid

May 22, 2011

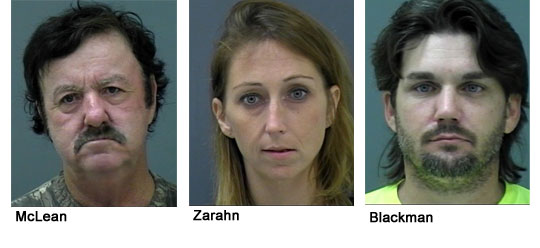

Three people were jailed after a meth lab raid outside Jay on Friday.

Santa Rosa County Sheriff’s Deputies raided the home off Country Mill Road about seven miles southeast of Jay — finding the equipment and ingredients to manufacture meth inside. The raid also uncovered prescription pills and marijuana.

Shawnda Everlyn Zarahn, 33, and 38-year old John Kevin Blackman were both charged with drug possession. Daniel Lee McLean, 58, was booked on felony probation. All three remained in the Santa Rosa County Jail as of late Saturday night.

Featured Recipes: Stir Up Some Fun

May 22, 2011

Who says entertaining guests has to be a lot of work? Whether it’s a dinner party or a casual get-together, with the right recipes you can stir up some crowd-pleasing dishes in hardly any time at all. From delicious dips to a cool twist on classic hot wings to a simple and savory casserole, these recipes make it easy to deliver fun and flavorful food.

(Scroll down to see all of today’s recipes.)

KING RANCH CHICKEN

Ingredients

- 1 packet ranch seasoning mix

- 1 green bell pepper, chopped

- 1/2 medium white onion, chopped

- 2 teaspoons canola or vegetable oil

- 18 6-inch yellow corn tortillas

- 1 1/2cups chicken stock

- 2 cups sour cream

- 1 pound Monterey Jack cheese, shredded

- 1 10-ounce can diced tomatoes with green chilies, such as Rotel; drained

- 1 4-ounce can green chilies, drained

- 1/2 pound chicken, cooked and cubed

- 1 teaspoon salt

- 1/2 teaspoon ground black pepper

Preparation

- Preheat oven to 375°F.

- Put the drained tomatoes and drained chilies in a medium bowl. Sauté the onions and bell peppers in the 2 teaspoons of oil until the onions turn translucent and the peppers are tender (2 to 3 minutes). Add to the bowl of tomatoes and chilies and mix to combine.

- Blend chicken stock, sour cream, dip mix, salt and black pepper until smooth.

- Spray the bottom of a 9 x 13 baking dish with cooking spray and cover the bottom of the pan with 6 yellow corn tortillas. Sprinkle 1/3 of the chicken and 1/3 of the vegetable mixture on the layer of tortillas. Pour 1/3 of the sour cream mixture over the vegetables and top with 1/3 of the shredded cheese. Repeat twice, beginning with tortillas and ending with a layer of cheese.

- Cover with foil and bake for 40 to 45 minutes or until hot in the center and cheese is melted.

Serves

Makes 6 to 8 servings

HOT CHICKEN WINGS WITH CUCUMBER RANCH DIP

Ingredients

Wing Sauce

- 3/4 cup hot sauce

- 1 tablespoon butter

Cucumber Ranch Dip

- 3 tablespoons ranch seasoning mix

- 1 cup Daisy brand sour cream

- 1/2 cup cucumber, peeled, seeded and diced

- 1/2 cup buttermilk (optional)

- 2 tablespoons lime juice

- 2 tablespoons cilantro

- Pinch pepper

Wings

- 16 chicken wings

- 3 tablespoons canola oil

Preparation

- Wing Sauce: Add hot sauce to a pot and bring up to medium heat.

- Add butter and whisk until melted. Set aside.

- Cucumber Ranch Dip: Add ingredients to a bowl and mix thoroughly using a rubber spatula. Set aside.

- Wings: Preheat oven to 425°F.

- Add wings to a sheet tray and toss with oil. Bake for 20 minutes.

- Once the wings are done in the oven, remove them from the sheet tray and dump them into a bowl.

- Add the hot sauce and toss until wings are evenly coated.

- Serve the chicken wings along with cucumber ranch dip for dipping.

Serves

Makes 4 servings

CREAMY GREEN ONION MINI MEATBALLS

Sauce for Meatballs

- 1/2 cup heavy cream

- 3/4 cup Daisy brand sour cream

- 4 ounces cream cheese

- 1 packet garden onion seasoning mix

Mini Meatballs

- 2 tablespoons garden onion seasoning mix

- 1 pound ground beef (preferably 80/20 ground chuck)

- 3 tablespoons Italian bread crumbs

- 1 tablespoon green onion, sliced

- 1 tablespoon garlic, minced

- 1 egg

- Pinch salt and pepper

- 2 tablespoons green onions, chopped – optional garnish

Preparation

- Sauce for Meatballs: Add heavy cream, sour cream and cream cheese to a sauce pot on medium heat. Whisk until ingredients are melted. Then add one packet of dip mix and whisk until smooth. Hold over low heat.

- Mini Meatballs: Preheat oven to 425°F.

- In a mixing bowl, add all ingredients and mix thoroughly. Roll the meat mixture into golf ball size meatballs. Place the meatballs on a sheet tray lined with parchment paper and bake for 15 minutes.

- Once baked, add the meatballs to meatball sauce and toss to coat. Serve hot. Garnish with chopped green onions if desired.

Serves

Makes 4 to 6 servings

EASY JALAPENO PEPPERS

Ingredients

- 8 medium sized jalapeños

- 4 ounces (1/4 pound) Monterey Jack cheese, shredded

- 8 slices of bacon

- 8 short wooden skewers or wooden toothpicks

- 1 packet guacamole dip prepared according to instructions

- 3 avocados

Preparation

- Create a slit in one side of the jalapeños using a small sharp knife. Do not cut all the way through the ends. Remove the seeds and membrane for a milder popper.

- Stuff a pepper with 1/8 of the cheese. Wrap with a slice of bacon and secure the bacon with a skewer. Repeat with the 7 other peppers.

- Preheat oven to 425°F. Sear poppers on all sides over high heat in a nonstick pan until bacon is golden brown. Transfer to a baking sheet and bake for 8 minutes.

- Serve hot with the guacamole on the side.

Serves

Makes 8 poppers

Video: Byrneville Fourth, Fifth Graders Perform “Funky Fifth”

May 22, 2011

Fourth and fifth grade students at Byrneville Elementary School performed Beethoven’s “Funky Fifth” Friday at the school under the direction of music teacher Elaine Holk.

You may need to be logged into your Facebook account to see this video. If you don’t see the video, it is because your home, school or work firewall is blocking Facebook videos.

ECUA Golf Tourney Nets $17K For Sacred Heart Children’s Hospital

May 22, 2011

Emerald Coast Utilities Authority (ECUA) Employees’ Golf Tournament organizers recently presented a check for $17,000 to Henry E. Roberts, president of the Sacred Heart Foundation. The donation was the result of the 2011 tournament held at the Scenic Hills Country Club on April 22.

“Over the past 14 years, the ECUA Employees’ Golf Tournament has contributed over $125,000 in the hospital’s ministry with children,” Roberts said.

“Over the previous years we made the annual event a top priority. The money generated will contribute to the building and construction of the Children’s Garden and Playroom Renovation project and renovation of Sacred Heart Children’s Hospital,” organizers stated.

“The tournament is successful because of the financial support we receive from Diamond Sponsor, Camp Dresser & McKee, over thirty additional sponsors, and the event participants. We are very proud of the excellent work the Foundation does in our community and we feel blessed to be able to contribute,” added Bill Ellis, one of the tournament organizers.

Sacred Heart Children’s Hospital is a state-of-the-art facility and is Northwest Florida’s only Level III intensive care nursery, serving 14 counties throughout the region.

Pictured top: Ron Doolittle; Cathy Laird, Sacred Heart fund development coordinator; Doug Gibson, Bill Ellis, and Dr. Henry E. Roberts, president of the Sacred Heart Foundation. Courtesy photo for NorthEscambia.com, click to enlarge.

Davis, Johnson To Wed

May 22, 2011

Darrin Sellers and Tonya Emmons of Cherry Point, NC, announce the engagement and forthcoming marriage of their daughter, Nicole Naomi Davis, to Justin Charles Johnson of Century, the son of Dianne Johnson and the late Dewayne Johnson.

Nicole is a 2006 graduate of Northview High School and a graduate of Pensacola State College with an AAS degree in accounting technology.

Justin is also a 2006 graduate of Northview High School. He is currently employed by Smith Industrial Services.

Nicole and Justin are high school sweethearts with a four-year old daughter, Daisy LaRehn Johnson.

The wedding will take place at noon on Saturday, June 4 at the Pleasant Grove Baptist Church on Butler Street in Atmore. Family and friends are welcome to attend.