Tips From The IRS On Year-End Gifts To Charity

December 30, 2016

The Internal Revenue Service today reminded individuals and businesses making year-end gifts to charity that several important tax law provisions have taken effect in recent years. Some of the changes taxpayers should keep in mind include:

Rules for Charitable Contributions of Clothing and Household Items

Household items include furniture, furnishings, electronics, appliances and linens. Clothing and household items donated to charity generally must be in good used condition or better to be tax-deductible. A clothing or household item for which a taxpayer claims a deduction of over $500 does not have to meet this standard if the taxpayer includes a qualified appraisal of the item with the return.

Household items include furniture, furnishings, electronics, appliances and linens. Clothing and household items donated to charity generally must be in good used condition or better to be tax-deductible. A clothing or household item for which a taxpayer claims a deduction of over $500 does not have to meet this standard if the taxpayer includes a qualified appraisal of the item with the return.

Donors must get a written acknowledgement from the charity for all gifts worth $250 or more. It must include, among other things, a description of the items contributed.

Guidelines for Monetary Donations

A taxpayer must have a bank record or a written statement from the charity in order to deduct any donation of money, regardless of amount. The record must show the name of the charity and the date and amount of the contribution. Bank records include canceled checks, and bank, credit union and credit card statements. Bank or credit union statements should show the name of the charity, the date, and the amount paid. Credit card statements should show the name of the charity, the date, and the transaction posting date.

Donations of money include those made in cash or by check, electronic funds transfer, credit card and payroll deduction. For payroll deductions, the taxpayer should retain a pay stub, a Form W-2 wage statement or other document furnished by the employer showing the total amount withheld for charity, along with the pledge card showing the name of the charity.

These requirements for the deduction of monetary donations do not change the long-standing requirement that a taxpayer obtain an acknowledgment from a charity for each deductible donation (either money or property) of $250 or more. However, one statement containing all of the required information may meet both requirements.

Reminders

The IRS offers the following additional reminders to help taxpayers plan their holiday and year-end gifts to charity:

- Qualified charities. Check that the charity is eligible. Only donations to eligible organizations are tax-deductible. Select Check, a searchable online tool available on IRS.gov, lists most organizations that are eligible to receive deductible contributions. In addition, churches, synagogues, temples, mosques and government agencies are eligible to receive deductible donations. That is true even if they are not listed in the tool’s database.

- Year-end gifts. Contributions are deductible in the year made. Thus, donations charged to a credit card before the end of 2016 count for 2016, even if the credit card bill isn’t paid until 2016. Also, checks count for 2016 as long as they are mailed in 2016.

- Itemize deductions. For individuals, only taxpayers who itemize their deductions on Form 1040 Schedule A can claim deductions for charitable contributions. This deduction is not available to individuals who choose the standard deduction. This includes anyone who files a short form (Form 1040A or 1040EZ). A taxpayer will have a tax savings only if the total itemized deductions (mortgage interest, charitable contributions, state and local taxes, etc.) exceed the standard deduction. Use the 2016 Form 1040 Schedule A to determine whether itemizing is better than claiming the standard deduction.

- Record donations. For all donations of property, including clothing and household items, get from the charity, if possible, a receipt that includes the name of the charity, date of the contribution, and a reasonably-detailed description of the donated property. If a donation is left at a charity’s unattended drop site, keep a written record of the donation that includes this information, as well as the fair market value of the property at the time of the donation and the method used to determine that value. Additional rules apply for a contribution of $250 or more.

- Special Rules. The deduction for a car, boat or airplane donated to charity is usually limited to the gross proceeds from its sale. This rule applies if the claimed value is more than $500. Form 1098-C or a similar statement, must be provided to the donor by the organization and attached to the donor’s tax return.

If the amount of a taxpayer’s deduction for all noncash contributions is over $500, a properly-completed Form 8283 must be submitted with the tax return.

Free Beans And Rice Giveaway Saturday In Cantonment

December 30, 2016

Saint Monica’s Episcopal Church, will be distributing free rice and dried beans and other non-perishables on New Year’s Eve from 9 until 11 a.m.m at the church located at 699 South Hwy 95-A in Cantonment. Recipients are also invited to enjoy a free sausage biscuit and coffee. For more information, call the church office at (850) 937-0001.

Saint Monica’s Episcopal Church, will be distributing free rice and dried beans and other non-perishables on New Year’s Eve from 9 until 11 a.m.m at the church located at 699 South Hwy 95-A in Cantonment. Recipients are also invited to enjoy a free sausage biscuit and coffee. For more information, call the church office at (850) 937-0001.

2016 In Photos: April

December 30, 2016

Today, we continue our look back at the year 2016 in photos with a look at April.

An April sunset in North Escambia.

After an absence of several years, baseball and softball returned in April to the Cantonment Ballpark.

Opening Day for Northwest Escambia at Bradberry Park in Walnut Hill.

It was announced that former Century High School and the football stadium on Hecker Road will be demolished due to tornado damage.

“The Bully Plays” was presented at Tate High School.

The 20th Annual Escambia County School District’s Special Olympics Spring Games were held in April at Tate High School with over 500 student athletes. Over 600 Tate student volunteers assisted as “buddies” and event workers.

The Escambia County Public Schools Foundation honored 68 of Escambia County’s outstanding creative high school seniors at the 2016 Mira Creative Arts Awards Ceremony in Pensacola, including these students from Tate High School.

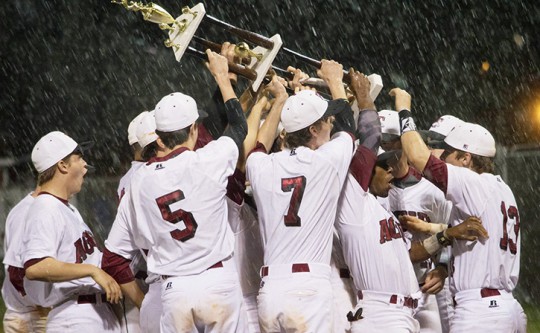

For the third year in a row, the Tate Lady Aggies won the District 1-7A title over Pace at Escambia High School.

An Earth Day Celebration was held in Century.

New members were inducted into the National Junior Honor Society during a candlelight ceremony at Ernest Ward Middle School.

The Gulf Coast Agriculture and Natural Resources Youth Organization (GCA & NRYO) Spring Livestock Show was held in Molino.

The first Black Jacket Jamboree beautiful baby contest was held during the Blue Jacket Jamboree in Molino.

The annual Blue Jacket Jamboree was held at the 4-H Center in Molino with arts and crafts, kids’ activities, food, a car show and more. All proceeds from the event benefited the Northview High School FFA and FFA Scholarship Fund.

ECSO Seeks Man For Allowing Minor To Have Gun, Trespassing

December 30, 2016

The Escambia County Sheriff’s Office is asking for the public’s help in locating 20-year old Keandre Lanell Wesley. He is wanted for trespassing, culpable negligence allowing a minor access to gun, and tampering with evidence. If you have any information contact Crime Stoppers at (850) 433-STOP or the Escambia County Sheriff’s Office at (850) 436-9620.

The Escambia County Sheriff’s Office is asking for the public’s help in locating 20-year old Keandre Lanell Wesley. He is wanted for trespassing, culpable negligence allowing a minor access to gun, and tampering with evidence. If you have any information contact Crime Stoppers at (850) 433-STOP or the Escambia County Sheriff’s Office at (850) 436-9620.

Cantonment Man Lands In Jail, Upset That He Didn’t Get Anything For Christmas

December 29, 2016

A Cantonment man landed in jail Christmas morning after becoming upset that he didn’t get anything for Christmas.

According to an Escambia County Sheriff’s Office arrest report, the female victim woke up about 6 a.m. and went into the living room of a home she shares as a family with 24-year old Jeremy Blake Bowlin in order to start Christmas gift giving. The victim said as she approached Bowlin, he “got an attitude” and went into a bedroom upset because he did not receive any gifts. He then walked around the house yelling and cursing about his life and how it has been a bad Christmas, the report states.

According to an Escambia County Sheriff’s Office arrest report, the female victim woke up about 6 a.m. and went into the living room of a home she shares as a family with 24-year old Jeremy Blake Bowlin in order to start Christmas gift giving. The victim said as she approached Bowlin, he “got an attitude” and went into a bedroom upset because he did not receive any gifts. He then walked around the house yelling and cursing about his life and how it has been a bad Christmas, the report states.

The victim began to pack her things and her childrens’ things to go to a relative’s home. Bowlin would not let her leave , blocking in her vehicle. Anytime that she attempted to leave, he would get into her car. She was finally able to leave after two hours. Bowlin followed her, drove in front of her and blocked the road so that she could not pass. The victim called 911.

Deputies caught up with the couples’ vehicles near Highway 29 and Nine Mile Road, conducting a traffic stop on Bowlin’s vehicle in the parking lot of Church’s Chicken on Highway 29. He was taken into custody without further incident.

The victim told deputies she had feared for her life during the incident.

Bowlin was charged with felony false imprisonment, stalking, possession of drug paraphernalia (a glass smoking device) and no driver’s license. He remained in the Escambia County Jail Thursday with bond set at $105,000.

Let ECUA Dispose Of Your Christmas Tree

December 29, 2016

The Christmas holiday is now just a fond memory, so what do you do with the Christmas tree?

Emerald Coast Utilities Authority (ECUA) customers can place their Christmas trees and green wreaths at the curb before 5:30 a.m. on their regular ECUA sanitation collection day. Trees should be free of tinsel, stands, ornaments and other added materials.

Wreaths must be free of frames, wire, and other non-organic material.

The collected real trees and wreaths will be collected with the yard trash and composted, while the artificial trees will be a part of the bulk waste collection process.

For additional collection information call ECUA Customer Service at (850) 476-0480, or visit www.ecua.fl.gov.

State Warns About Ticket Scam

December 29, 2016

The Florida Department of Highway Safety and Motor Vehicles is warning about a scam in which motorists receive emails about fictitious red-light citations.

The scam, which has been happening for a few weeks, includes victims being asked for prompt payment to avoid extra fees. The emailed notice includes a hyperlink to a payment page and threatens recipients with repeated late fees and suspension of their driver’s licenses if payments are not sent.

The scam, which has been happening for a few weeks, includes victims being asked for prompt payment to avoid extra fees. The emailed notice includes a hyperlink to a payment page and threatens recipients with repeated late fees and suspension of their driver’s licenses if payments are not sent.

Department of Highway Safety and Motor Vehicles spokeswoman Beth Frady said the bogus email includes the department’s logo, making it look more legitimate. But she said the department does not email citations, and online payments are not required by the department.

“If they have received this email, they need to either ignore it, or if they have responded and were a victim, they need to go ahead and refute the charges with their financial institution as well as put fraud alerts on their accounts,” Frady said.

Motorists who receive citations they think might be scams may contact the Department of Highway Safety and Motor Vehicles or local clerks of court.

Molino Park Elementary Principal Appears On ‘Good Morning America’

December 29, 2016

Molino Park Elementary School Principal Lisa Arnold made a brief appearance on ABC’s Good Morning America on Wednesday. Senior meteorologist Rob Marciano spoke to Arnold on air. Lisa Arnold was in New York City with her daughter Emily. Courtesy images for NorthEscambia.com, click to enlarge.

Teacher ‘Best And Brightest’ Bonus Program Could Face Changes

December 29, 2016

The controversial “Best and Brightest” bonus program for Florida teachers could be headed for changes in the upcoming legislative session, though the dimensions of those revisions are still murky.

Gov. Rick Scott has signaled that he will propose a different way to attract and keep high-quality teachers in the state’s public schools.

House leaders, the current program’s strongest backers, have indicated they are open to some changes. And at least some members of the Senate, which has resisted Best and Brightest’s reliance on teachers’ test scores in awarding bonuses, appear to be interested in taking another run at overhauling the program.

House leaders, the current program’s strongest backers, have indicated they are open to some changes. And at least some members of the Senate, which has resisted Best and Brightest’s reliance on teachers’ test scores in awarding bonuses, appear to be interested in taking another run at overhauling the program.

Adding to the questions about the program: The author of Best and Brightest, former House Education Appropriations Chairman Erik Fresen, and one of its chief critics, former Senate Education PreK-12 Chairman John Legg, are no longer in the Legislature.

“Just strap on your seat belt for that (discussion), because it will be an interesting journey,” said Sen. David Simmons, an Altamonte Springs Republican who chairs the Senate’s public-schools budget panel, at a recent committee meeting.

The chief complaint about Best and Brightest is its reliance on teachers’ scores on college admissions tests. Under Best and Brightest, first approved by lawmakers in 2015, teachers who are highly rated and scored in the top fifth of the test results on the SAT or ACT, are eligible for bonuses of up to $10,000.

But critics say using exams like the SAT and the ACT is unfair to older teachers, whose scores are decades old or who don’t have ready access to the information. The state’s largest teachers union, the Florida Education Association, filed a complaint in 2015 with the U.S. Equal Employment Opportunity Commission claiming the program discriminates on the basis of age and race.

The Florida Board of Education has approved a budget plan that would do away with the program, which received $49 million in the budget year that runs until June 30. Lawmakers will start their annual session in March and will approve a budget for the fiscal year that starts July 1.

Under the Board of Education plan, the Florida Department of Education would create a $43 million program that would “support bonuses for new teachers who show great potential for and veteran teachers who have demonstrated the highest student academic growth among their peers,” according to a summary of the proposal.

Education Commissioner Pam Stewart has not unveiled a more detailed version of the plan, and Scott has not gone into detail about his recommendations for education spending next budget year.

However, talking to reporters after a meeting of teachers of the year in October, the governor indicated he was listening to educators’ complaints about the bonuses and would support the board’s ideas.

“What I’ll be putting in the budget is $43 million for a program that retains and recruits teachers,” Scott said. “Now, we’re going to continue to get advice, get counsel, get ideas from all these teachers, because if you think about who’s going to know the best how to do it, it’s going to be them. They know how they were recruited. They knew why they’re doing what they’re doing.”

House leaders have signaled a willingness to alter the program — to an extent. Education Chairman Michael Bileca, R-Miami, said recently that the House might be willing to open up the program.

“We have heard the feedback in terms of, it should be based on this or that, and I think we are going to look at how do we make it more expansive,” Bileca said. “Because the end goal is having the best possible teachers in the classroom. I don’t think that excludes, though, other avenues on how do we attract the best possible teachers in the classroom.”

At the same time, House leaders continue to point to studies indicating teachers who did well on the SAT and ACT also perform better in the classroom.

Speaker Richard Corcoran, R-Land O’ Lakes, indicated that the changes the House would consider might include, for example, lowering the bar for at least some teachers to qualify for the awards. A bill filed last year by Legg would have allowed veteran teachers who scored in the top 40 percent of test-takers to claim the bonuses.

“We could probably lower it down,” Corcoran said. “As much as the Senate screamed and hollered — or at least, one or two of them did — they passed a version of it. So obviously, they believe in it too. All we’re doing now is arguing over lines.”

But in his remarks this month, Simmons hinted there might be broader changes.

“I think that there are things that we can (do to) accomplish what the House wants to accomplish and at the same time be able to reduce the criticism that might exist as to the methodology in rewarding these teachers for the hard work that they’re doing,” he told reporters. “It breaks my heart when I see teachers having to work in the evening just to make ends meet. We’ve got to improve teacher compensation.”

Simmons floated the possibility of expanding the number of teachers who are eligible for the award, or introducing a graduated scale for teachers.

Senate President Joe Negron, R-Stuart, was guarded about what changes might be in the offing.

“I can’t predict how it’s all going to unfold ahead of time, but I know that it’s important to the House to have additional compensation for highly qualified teachers. For me, that’s the issue,” Negron said “How to do it and what the best mechanism is, that’s why we have the session — to determine that.”

by The News Service of Florida

2016 In Photos: March

December 29, 2016

Today, we continue our look back at the year 2016 in photos with a look at March.

Traffic was shifted to a new Highway 97 bridge over Little Pine Barren Creek in Walnut Hill. The $2.5 million project was, however, only partially done as crews will work to remove a temporary bridge and add a final layer of asphalt to the bridge approach.

Local lawmakers are looking for solutions after a stalled CSX train blocked crossings from Becks Lake Road in Cantonment north to McKenzie Road in Cottage Hill, leaving numerous residents unable to enter or exit their neighborhoods for hours. It was the second time in two months that the crossings were blocked for hours by a train.

About 800 students from across the area took part in the annual Northview High School FFA “Fresh From Florida” program at the school in Bratt.

A couple of Canada geese checked out Lake Stone in Century in March.

Tate High School won their Aggie Classic.

“The Way We Worked,” a Smithsonian Traveling Exhibition, opened in Molino.

Representatives of Legal Service of Northwest Florida were at the Century Town Hall providing free property related legal assistance for tornado victims.

Alabama officials blamed Atmore flooding on this bridge on Greenland Road in Davisville.

The Atmore Memorial VFW Auxiliary hosted a “Welcome Home Vietnam Veterans Day” ceremony at Atmore’s Heritage Park.

An Easter sunset.

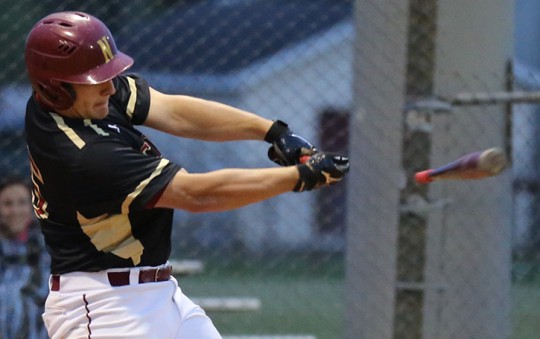

Northview’s Jared Aliff splintered a bat during a March game against Jay.

Ashlan Harigel, 14, was named Miss Ernest Ward Middle School Saturday night in “Celebrate Music” themed pageant at the school.

New LED street lights were installed along Callaway Street in Cantonment.